This Quarter in Crypto

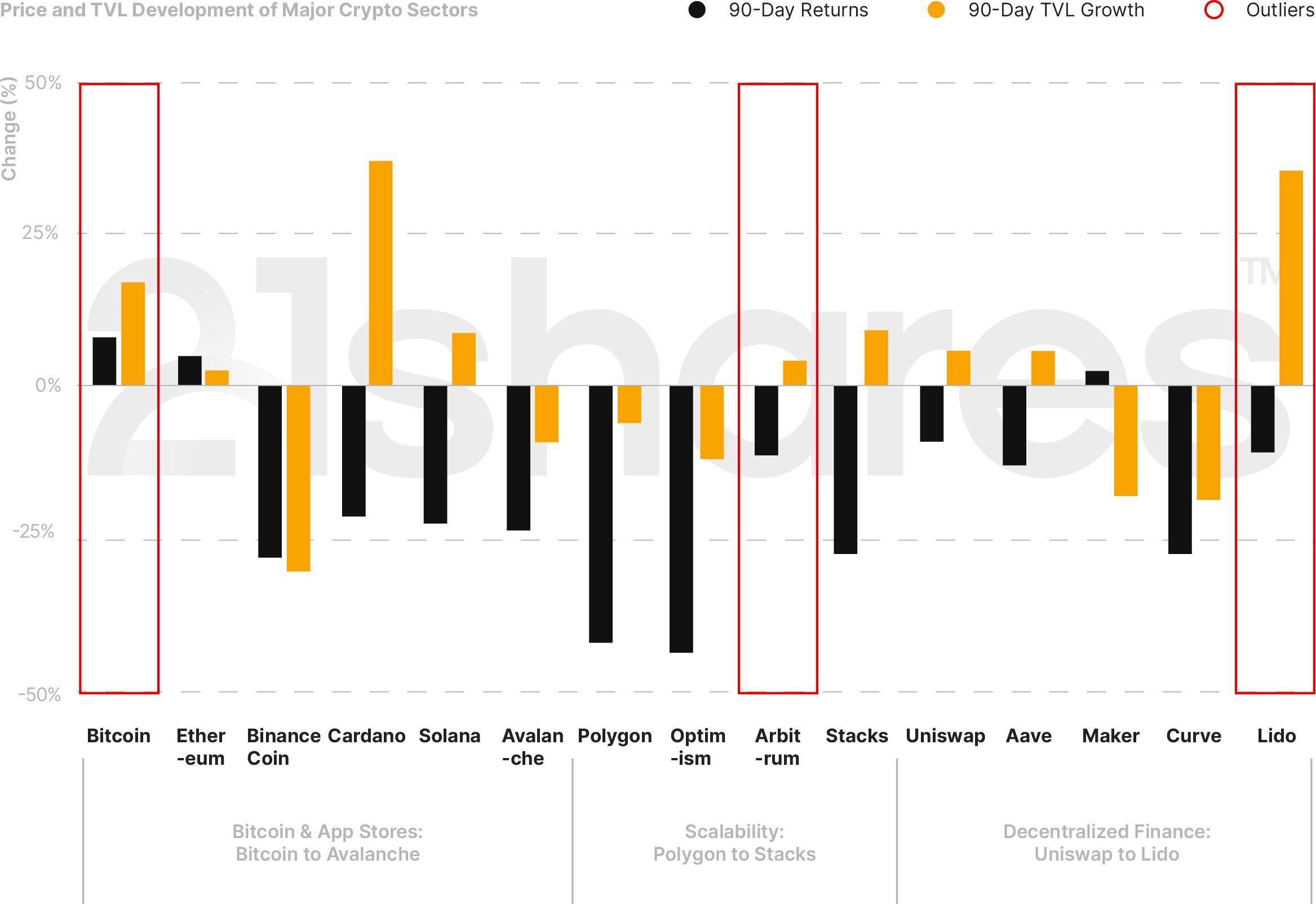

Growing institutional adoption, on the back of new Bitcoin ETF applications in the U.S., has reignited the crypto flame, pushing Bitcoin to its highest level since 2022: $31.2K. Over the past quarter, Bitcoin and Ethereum increased by around 8% and 5%, respectively. Scalability solutions suffered the most. Falling by 7%, Arbitrum came out with the least losses in Q2 in comparison with its peers, as shown in Figure 1. In the realm of DeFi, Lido was the frontrunner, soaring by 35% in TVL. This jump could be attributed to Lido’s success in executing its staked ETH withdrawals.

Figure 1: Quarterly TVL and Price Performance of Major Crypto Categories

Source: Coingecko and DeFi Llama. Close data as of Jun 26, 2023.

5 Trends To Remember From Q2

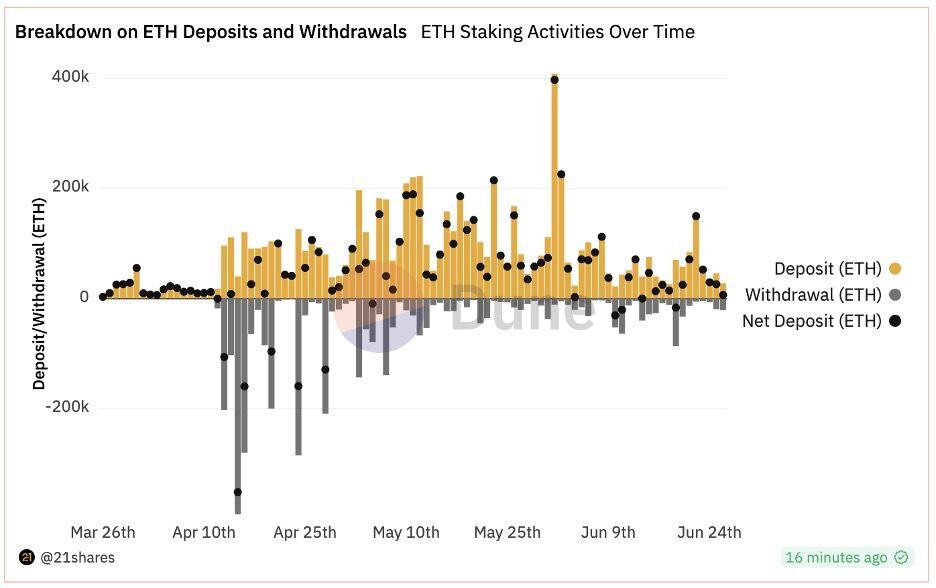

- After a long wait, investors can finally withdraw their staked Ether: Since the Ethereum staking contract launched in December 2020, investors who wanted to validate transactions and secure the network had to withstand an indefinite lockup period on their Ether (ETH). On April 12, the Shanghai upgrade was activated, closing the loop on staking liquidity by allowing investors to finally withdraw their locked ETH. Despite ~73k validators exiting the network as of June 26, Ethereum staking has seen almost 4 million ETH in net new deposits since April 12. This shows that enabling withdrawals has reduced the liquidity risk for investors, particularly institutions.

Figure 2: Breakdown of ETH Deposits and Withdrawals

Source: 21shares on Dune Analytics

- Binance faces hurdles in the U.S. and Europe: The world’s largest crypto exchange and its founder are facing 13 charges, which include operating an unregistered exchange, commingling of assets, and misrepresenting trading controls and oversight on the Binance.US platform. While the lawsuit filed by the Securities and Exchanges Commission (SEC) is still pending a verdict, Binance’s balance fell by almost 8% this quarter. Selling pressure could have also been partly influenced by some less tense trouble Binance has been facing in Europe. The exchange exited the Netherlands after failing to get regulatory approval as a virtual asset provider. France is also preliminarily investigating Binance for alleged money laundering, to which Binance’s CEO appeared relaxed, saying that they have collaborated with the French authorities and that this legal procedure is the norm in France. With the Markets in Crypto Assets (MiCA) regulatory framework going into effect by the beginning of next year, Binance has voluntarily exited other European countries, like Austria and Cyprus, to reportedly focus on complying with MiCA.

Continue reading: https://21shares.com/research/monthly-review-jun-23