An analysis which, however, seems to be based solely on large crypto holders.

The cryptocurrency market has been experiencing a resurgence since late 2023, with prices once again reaching record highs. However, rising prices don't seem to be enough to reignite consumer enthusiasm for cryptocurrency ownership. Indeed, a recent analysis conducted by the Federal Reserve Bank of Philadelphia shows a persistent mismatch between rising market prices and the number of people owning crypto assets. A reality that raises questions about current market dynamics.

A disconnect between bull market and asset acquisition

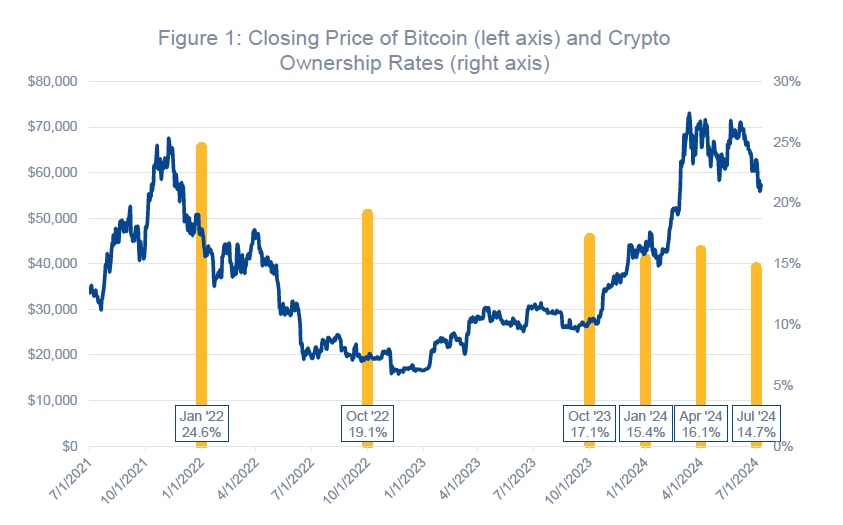

According to the study published in September 2024 by Tom Akana of the Consumer Finance Institute (CFI), interest in buying and holding cryptocurrencies, particularly Bitcoin, is not following the same curve as prices. The findings are based on several waves of surveys conducted by CFI between January 2022 and July 2024. These surveys clearly show a continuing decline in the percentage of people holding cryptocurrencies, even during the recent price recovery.

In 2022, "crypto winter" had caused prices to fall drastically, and this downturn was accompanied by a notable drop in the number of digital asset holders. Between January 2022 and October 2022, cryptocurrency ownership fell from 24.6% to 19.1%, in line with the market's decline. However, the dynamic changed from 2023 onwards. Although the market recovered, with impressive rises in the Bitcoin price (up to 60% between October 2023 and March 2024), holding rates didn't follow. In April 2024, for example, the ownership rate was just 16.1%, barely higher than in October 2023, and by July 2024 this figure had even dropped to 14.7%.

A price rise that attracts, but fails to convince

These data raise questions about the factors influencing consumers' decisions to hold or acquire cryptocurrencies. It would appear that rising prices are no longer enough to convince new buyers, although interest in a future acquisition does seem to be on the rise.

In fact, the study highlights that the intention to purchase in the future has increased significantly, particularly among non-holders. In the April 2024 survey, 21.8% of respondents said they were likely to buy cryptocurrencies in the future, compared with just 10.6% in October 2022. This increase in the desire to acquire clearly shows the persistent appeal of cryptocurrencies, but an appeal that is still tentative and does not translate into immediate buying action.

Why the disconnect?

There are several possible explanations for this disconnect between rising prices and consumers' lack of immediate reaction.

- An uncertain macroeconomic environment: investors may be reluctant to jump into cryptocurrencies, even with rising prices, due to global economic uncertainties, fluctuating regulations or fears about the volatility of digital assets.

- A memory of past crises: the still-fresh memory of previous collapses, such as that of 2022, could hold back potential investors. Although prices have recovered, the perceived risk remains high, and consumers might wait for more stable signs before reinvesting heavily.

- More cautious investor profiles: the study also highlights that the profiles of cryptocurrency holders have evolved. While asset ownership was more diffuse in 2021, respondents now appear to be more experienced and cautious, which could explain the reluctance to enter or re-enter the market.

Studies that qualify the Fed's findings

Other analyses offer a different perspective. A January 2024 report from Crypto.com reveals that the number of cryptocurrency users jumped 34% in one year, reaching 580 million despite low prices. In France, ADAN estimates that 12% of French people owned cryptos at the start of 2024, compared with 8% in 2022.

These figures, though divergent, could be explained by distinct methodologies, with some studies including small holders, while the Fed probably focuses on more significant holders.

Towards a recovery in the holding market?

Despite these findings, the market's growth potential remains very much alive. While current asset ownership is not increasing, purchase intent, particularly among non-owners, is showing an upward trend. This could signal a rebound in the next few years, provided economic and regulatory conditions become more favorable.

The cryptocurrency market therefore appears to be heading for a period when only the most sophisticated investors are jumping into asset buying, while the general public remains on the sidelines. While rising prices are attracting attention, they are not yet convincing enough to drive a recovery in possession rates.

What's the outlook for wealth management experts?

In this context, wealth management experts, private bankers and family offices must adapt their approach in the face of increasingly cautious clients, while remaining attentive to rapid developments in the cryptocurrency market. Interest in cryptocurrencies could increase further, but it seems necessary to clearly identify investors' risk profiles and support their decisions with a long-term strategy.

Market fluctuations are no longer enough to motivate investors to take the plunge, so the role of advisors becomes crucial in informing decisions in a sector that remains as volatile as it is fascinating.

This post was translated from the original French.